Maximizing Cashflow: Best Practices for Automated Invoicing and Payments

Manual invoicing drains your team’s time and holds back your cashflow. Delays in payments create a ripple effect that stalls your entire operation. Automated invoicing powered by Track Works software solves this by speeding up billing and payment systems, so your cashflow optimization supports steady business growth. Let’s explore the best practices that will make your field service management more productive and profitable.

Boosting Cashflow with Automation

Transitioning to an automated invoicing system can transform your business operations, providing a clear path to improved cashflow. You gain more than just time; you secure a reliable financial system that powers your growth.

Benefits of Automated Invoicing

Automated invoicing offers a suite of advantages that manual systems can’t match. Firstly, it reduces human error. When you rely on automation, mistakes in calculations or client details become rare. Statistically, automated systems reduce errors by up to 90%.

Secondly, automated invoicing speeds up processes. Imagine sending invoices immediately upon job completion. This speed not only improves cashflow but also enhances client trust. Clients appreciate timely transactions, increasing their likelihood of repeat business.

Finally, the data collected through automated invoicing provides valuable insights. You can track who pays on time and who doesn’t, allowing you to make informed decisions about future client relationships. These insights help tailor your business strategies to boost profitability.

Streamlining Payment Systems

Efficiency in payment systems directly impacts your financial health. With automated systems, payments are processed faster, eliminating delays that could disrupt your cashflow.

One of the most significant benefits is the ability to handle multiple payment options. Whether it’s credit, debit, or digital wallets, giving your clients flexibility enhances satisfaction and encourages prompt payments.

Moreover, automated reminders ensure that overdue payments are minimized. This feature keeps payments on track without the need for manual follow-up, saving you time and effort.

Enhancing Field Service Management

By integrating advanced software like Track Works, your field service management becomes more streamlined and less prone to errors. This integration is key in boosting productivity and profitability.

Integrating Track Works Software

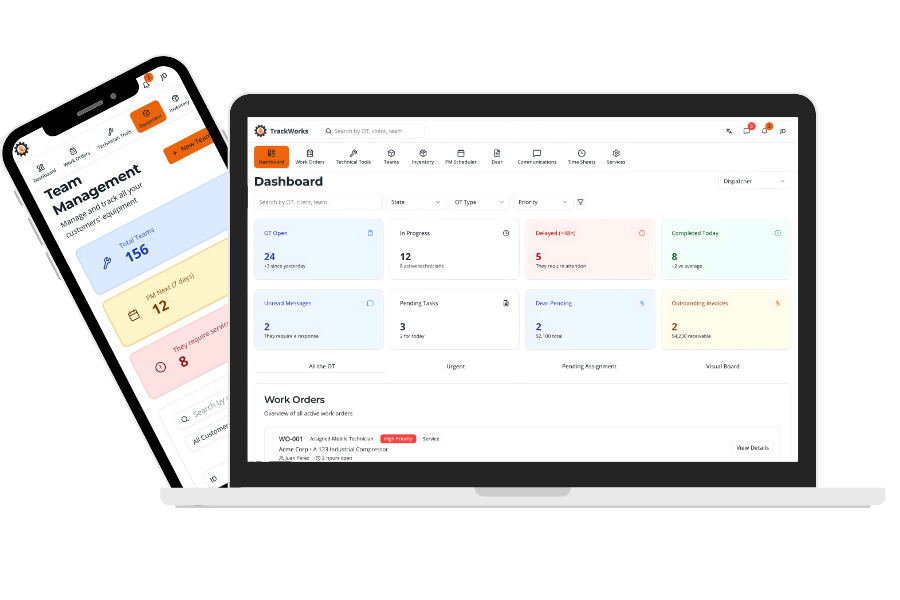

Track Works offers a comprehensive solution for field service management. Seamlessly integrating this software into your operations simplifies tasks and improves efficiency. You can manage everything from job scheduling to billing from one platform.

The real power of Track Works lies in its ability to integrate with existing systems. This compatibility means you don’t need to overhaul your current setup. Instead, Track Works enhances what you already have, making it easier to manage your field service operations.

The software also provides robust analytics. By tapping into real-time data, you can make better business decisions, improving your operational efficiency.

Real-Time Payment Updates

Keeping track of payments in real-time is crucial for maintaining a healthy cashflow. With Track Works, you get instant payment updates, allowing you to know exactly where your finances stand at any moment.

This immediacy aids in decision-making, letting you respond to financial challenges swiftly. Should a payment be delayed, you can act right away to address the issue, preventing it from escalating.

Moreover, real-time tracking ensures transparency. Clients can trust your service knowing you have a handle on every transaction. This trust translates into stronger client relationships and more business opportunities.

Driving Business Growth and Efficiency

The aim of automation is not just to save time but to drive growth. By improving financial processes, your business can scale with ease.

Improving Financial Efficiency

An organized financial system is the backbone of any successful business. Automated invoicing and payment systems streamline financial processes, ensuring accuracy and reliability.

Businesses that implement automation see a 30% increase in processing efficiency. This boost allows you to allocate resources to other growth areas, like marketing or product development.

Additionally, automation reduces labor costs associated with manual invoicing. The money saved can be reinvested into your business, fueling further expansion.

Supporting Long-Term Growth

For sustainable growth, businesses must adopt systems that support scalability. Automated solutions like Track Works offer that scalability, letting your operations grow without growing pains.

With automation, you can handle increased workloads without needing additional staff. This capability is essential for businesses looking to expand quickly while maintaining quality service.

In conclusion, the longer you wait to upgrade to automated systems, the more opportunities you miss. Embrace automation today for a future of ease, efficiency, and growth. Streamline your field service operations, reduce inefficiencies, and increase profitability. Explore Track Works on our website or contact us for more information and see how easy it can be to manage your business efficiently.

No responses yet